How to Accept Credit Card Payments for Small Business

A merchant account allows your business to accept customer payments via credit card, debit card, or other payment methods. By setting up a merchant account, you can make it easier for customers to purchase products and services from your business.

Here are the steps to set up your merchant account and start processing payment cards.

There are many payment processors to choose from, so shopping around and finding one that fits your business needs is essential. Make sure to read the terms and conditions of the processor you prefer to avoid any unexpected fees.

Once you’ve chosen a payment processor, you will need to create a merchant account. It is the account that will store all of your payment information. You will be asked to provide personal information, such as your name, address, and Social Security Number. Double-check all of this information to make sure it is correct.

A payment gateway is a secure connection between your website and your payment processor. It allows customers to pay with their credit or debit cards securely. Setting up a payment gateway can be tricky, so it’s essential to research and find a reliable payment gateway provider.

Once you’ve set up your merchant account and payment gateway, you need to integrate them into your website. It connects your merchant account with your website so customers can make payments. Depending on your website type, it can be done using plugins or coding.

Once you’ve set up your merchant account and payment gateway, it’s time to test and verify your account. It is essential to ensure everything is working correctly and customers can make payments without issues.

How to Accept Credit Card Payments for Small Business

For small businesses, credit card payments offer many benefits, such as:

- Credit cards are the preferred payment method for many customers, and showing credit card payments can increase sales.

- Credit card payments are fast, secure, and convenient for customers

- By accepting credit card payments, businesses can get paid faster.

- Credit card payments are secure and provide additional protection for the business and the customer.

Getting started with credit card payments for your small business is easy. Generally, businesses need to have a valid merchant account, a payment gateway, and a point-of-sale (POS) system.

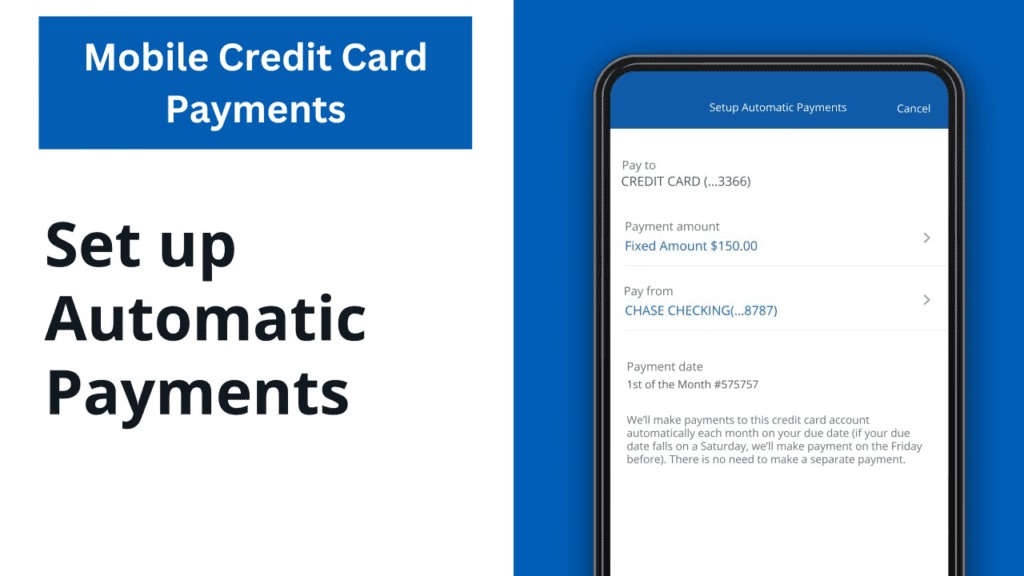

Types of Mobile Credit Card Payment Solutions

There are several types of mobile credit card payment solutions available today. These include mobile wallets, credit card processors, and third-party payment gateways. Each of these solutions provides different features and benefits that can help businesses make the best use of their payment processing capabilities.

In detail, let’s look at these types of mobile credit card payment solutions.

- Mobile Credit Card Processors

Mobile credit card processors are software applications installed on a customer’s mobile device. These applications allow customers to make payments directly from their phones by scanning the payment information on their credit cards.

The processing of payments is done through a secure connection, and the customer receives an authorization code that can be used to complete the transaction.

- Third-Party Payment Gateways

Third-party payment gateways are mobile credit card payment solutions that allow customers to make payments through a third-party processor. These payment gateways are typically integrated with a merchant’s website and offer customers the ability to make payments directly from their mobile devices.

Third-party payment gateways offer merchants a secure, efficient way to process payments and customers the convenience of not carrying their physical credit cards around.

- Mobile Wallets and Payment Apps

Mobile wallets and payment apps are the most popular mobile credit card payment solution. The most common mobile wallets are Apple Pay, Google Pay, and Samsung Pay, which allow customers to store their credit cards, debit cards, and loyalty cards for convenient payment.

Payment apps like Venmo, PayPal, and Square Cash also let customers pay with their phones. These apps provide an easy and secure way for customers to make payments, access their transactions, and check their balances.

- Point-of-Sale Systems

Point-of-sale (POS) systems are another mobile credit card payment solution. POS systems connect to credit card and debit card terminals, allowing customers to quickly and securely make payments and access their accounts.

Many POS systems also offer loyalty programs, discounts, and other features to help businesses boost sales and customer engagement.

You may also like: Mobile Point of Sale Solutions for Retailers, Restaurants & Events

- NFC Payments

As technology continues to advance, so do the ways we make payments. NFC payments, or Near Field Communication payments, are a relatively new payment option quickly becoming popular among many consumers.

NFC payments have the potential to revolutionize the way we make payments, offering convenience and ease of use for both consumers and merchants

- Credit Card Readers

As small businesses increasingly embrace the convenience of cashless payment options, credit card readers have become an invaluable tool for any business.

Credit card readers offer an efficient, secure, and cost-effective way to accept card payments from customers and clients, whether you’re just starting or looking to upgrade your existing payment system. We will explore the various types of credit card readers, their benefits, and how to choose the right one for your business.

Mobile Credit Card Payment Solutions

Mobile Credit Card Payment Solutions are revolutionizing how merchants and customers conduct transactions. It is a fast, secure and convenient way for commerce.

With mobile credit card payment solutions, customers can make payments on the go, anytime, anywhere, making it easier for customers and merchants to receive payments.

Here are some of the best mobile credit card payment solutions currently available.

Best Practices for Mobile Credit Card Payment Solutions

As the world of commerce continues to evolve, mobile credit card payment solutions are becoming increasingly popular. With the right mobile payment solution, businesses can save time, enhance customer experience, and maximize revenue. That said, there are some best practices business owners should consider when choosing a mobile credit card payment solution.

- Choose a Solution That’s Secure:

Select a provider that uses a secure payment gateway and provides comprehensive fraud protection. Look for solutions that use a PCI-compliant payment processor, such as Stripe.

- Offer Multiple Payment Options

Look for solutions that provide multiple payment methods, such as Apple Pay, Samsung Pay, Android Pay, and PayPal. It will make it easy for customers to use their preferred payment methods.

- Leverage Mobile Optimization

Mobile-optimized payment processing is becoming increasingly important. It’s essential to choose a solution that can be used on any device, from smartphones to tablets. It will ensure your customers can make payments without any hassle.

- Keep the Checkout Process Simple

The checkout process should be as simple and streamlined as possible. Look for a payment processor that offers one-click payment and quick checkout options. It will reduce cart abandonment and increase customer satisfaction.

Benefits of Using Mobile Credit Card Payment Solutions

As consumers increasingly rely on mobile technology, the need for secure, efficient payment options rises. Mobile credit card payment solutions provide both convenience and security for customers.

Here are just a few of the benefits of using mobile credit card payment solutions:

- Increased Efficiency:

Mobile credit card payment solutions make it easier and faster for customers to complete transactions. It eliminates the need to fill out paper forms, wait in long lines, and manually enter credit card information, and this convenience encourages customers to complete purchases quickly and easily.

- Enhanced Security:

By eliminating the need for customers to enter their credit card information manually, mobile credit card payment solutions reduce the risk of fraud. Customers can rest assured that their data is secure and that their transactions are conducted safely.

- Increased Customer Satisfaction:

Mobile credit card payment solutions allow customers to pay quickly and securely, which boosts customer satisfaction. Customers can complete transactions quickly and easily, encouraging them to return to the same business in the future.

- Increased Loyalty:

Mobile credit card payment solutions make it easier for customers to make repeat purchases. It encourages customers to return to the same business and boosts customer loyalty.

- Increased Profits:

Businesses can increase their profits as customers become more comfortable making mobile payments. Mobile credit card payment solutions encourage customers to make purchases quickly and easily, leading to increased business sales.

Disadvantages

Mobile credit card payment is one of the most popular revenue methods due to its convenience and cost-effectiveness.

However, some disadvantages to using this method need to be considered before making the switch.

- First, mobile credit card payment is not as secure as other payment methods. While the technology used for mobile payments is secure and encrypted, there is always the possibility that someone could hack the system and gain access to your personal information. Additionally, if you lose your device, it isn’t easy to prevent someone from using your stored credit card information.

- Second, mobile credit card payment can be more expensive than other payment methods. While it is convenient and cost-effective, you may incur higher fees for using your credit card via mobile than you would if you used cash or a debit card. It is because credit card companies charge higher prices to cover the merchant services cost

- Third, mobile credit card payment is not accepted by all merchants. While most major retailers and businesses accept mobile payments, there are still some that do not. It can be a problem if you travel and need a particular service or product.

- Finally, mobile credit card payment can be time-consuming. Because you must enter your personal information each time you make a purchase, it can take longer to complete a transaction than it would if you used cash or a debit card.

How to Avoid Common Mistakes When Accepting Credit Card Payments

There are several mistakes that businesses can make when accepting credit card payments, and these mistakes can cost you money and time. Fortunately, you can avoid these mistakes and ensure that your business can accept credit card payments without any issues.

1. Know the Different Types of Credit Cards:

Not all credit cards are created equal, and there are different types of credit cards, each with its rules and regulations. Make sure you understand the differences between Visa, Mastercard, American Express, Discover and other major credit cards so you can appropriately accept payments,

2. Understand Your Fees:

Before accepting credit card payments, ensure you understand the process’s fees. Different card networks and payment processors have additional costs, so ensure you know the breakdown of prices so you can properly budget for them.

3. Implement a Secure Payment System:

When accepting credit card payments, it’s essential to ensure that you have a secure payment system. You should use a payment gateway or other fast payment processor to ensure that customers’ payment information is safe and secure

4. Follow PCI Compliance Standards:

If you want to accept credit card payments, follow the Payment Card Industry Data Security Standard (PCI DSS) regulations. Must follow a set of standards to protect customers’ payment information, and failure to follow these standards can result in hefty fines.

5. Be Aware of Fraud prevention:

Credit card fraud is a real threat, and it’s essential to be aware of fraud prevention measures to protect your business. Implementing fraud prevention measures, such as address verification, card verification values, and 3D Secure is essential for companies that want to accept credit cards.

Challenges of Using Mobile Credit Card Payment Solutions

The use of mobile credit card payment solutions has revolutionized the way we do business. Allowing customers to purchase with their phones has opened up a world of possibilities. But as with anything new, there are always challenges to overcome. Here are some of the biggest challenges of using mobile credit card payment solutions.

Security:

Security is one of the biggest challenges of using mobile credit card payment solutions. Customers need to feel secure when they input their credit card information into their mobile devices. To ensure that customers are protected, technology needs to be updated regularly and up to date to protect against fraud.

Convenience:

With mobile credit card payment solutions, customers don’t need to be present to complete their transactions. It is excellent for customers who don’t have access to a physical store or don’t want to wait in line. But this convenience also comes with risks. Customers must ensure their data is secure when using their mobile devices for payments.

Scalability:

Mobile credit card payment solutions are great for small businesses, but they need to scale up when the business grows. It means that these solutions need to handle a more significant number of transactions and data.

Integration:

Mobile credit card payment solutions also need to integrate with existing payment systems. It means that these solutions need to be able to connect with existing payment platforms, such as POS systems and payment gateways. Customer service: With any payment solution, customers need to feel supported when they have questions or concerns. As such, mobile credit card payment solutions need to provide customer service that is both efficient and friendly.

Credit Card Processing Fees for Small Business

For small businesses, credit card processing fees can be a substantial expense. To ensure secure payments and protect customers, providers charge fees for their services, such as conducting fraud checks and verifying with the customer’s bank that funds are available. When a customer swipes, taps, or dips their credit card, the payment terminal quickly runs these security measures in a few seconds. Understanding the fees associated with credit card processing allows you to make informed decisions when selecting a provider and ensure your business is protected.

Conclusion

Our analysis of mobile credit card payment concludes that it is one of the most convenient payment methods available. Not only does it enable users to make payments quickly and securely, but it also enables them to make payments from any location at any time. It is an excellent option for those who travel frequently or need to make payments quickly.

It is also possible to track payments, manage accounts, and even use rewards programs. Finally, businesses should consider offering mobile credit card payment as a payment option, enabling them to provide their customers with a secure and convenient payment option. Additionally, companies should keep up with the latest advancements in mobile payment technology, allowing them to provide their customers with a more secure and convenient payment experience.

Recent Posts

- Securing Your Small Business: Best Practices in Payment Security

- How Small Business Merchant Services Can Boost Your Bottom Line?

- The Impact of E-commerce on Small Business Merchant Services

- How Merchant Services Can Support Growth for Small Businesses

- Unlocking the Potential: The Pros and Cons of Open Source Retail POS Systems

Recent Comments

- digital marketing agency Sydney on How Long Does a Credit Card Payment Take To Process?

- EndoliftX on How Long Does a Credit Card Payment Take To Process?

- heng678 on How Long Does a Credit Card Payment Take To Process?

- ปริ้นโปสการ์ด on How Long Does a Credit Card Payment Take To Process?

- 888vipbet on How Long Does a Credit Card Payment Take To Process?

Comments are closed.